How you handle the costs of dying depends on where you live, whether you think Medicaid might be in your future and where your highest level of trust is – but paying ahead makes a lot of sense.

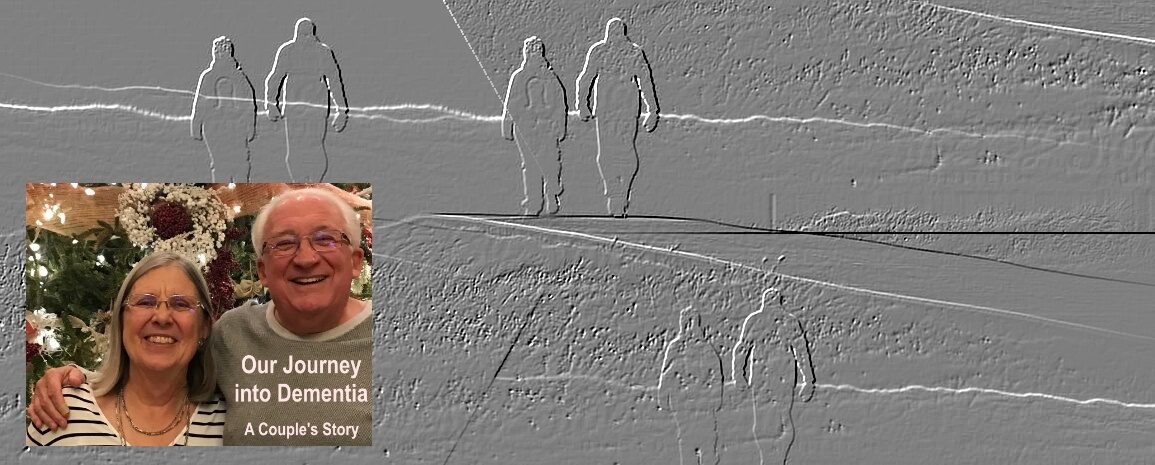

This is part of an ongoing series about our family’s experience with dementia. There is no order to it, just observations, reflections and, I hope, some guidance for others on this journey or who may someday begin it. It is not intended as any sort of financial, medical or psychiatric advice. Just one family’s experience…

LET’S TALK DYING.

As in, burial.

Two or three years ago Connie went around to all the local funeral homes to check out the cost of pre-paid services. In our case it was going to be cremation in a cardboard box. The basics. She got the costs, but we never acted on it.

This week I met with the finance folks at our care center to go over some things, including what happens if we both live long enough, needing care, to go broke and Medicaid steps in. The executive director asked me if we had pre-paid our funerals. I said we’d looked but hadn’t bought.

“You should,” she said. “If you pre-pay a funeral that is not an asset and Medicare won’t take it. If you have cash set aside, that will have to go for your care.”

Hmmm. So, I began doing some serious digging and decided it was worth sharing.

First, let’s look at some costs for cremation. If you plan on embalming, a viewing, a fancy casket and graveside service, you can figure $8,000 and up depending on where you live. If you don’t already own a cemetery plot, that figure can climb. If there are two of you, double all the costs.

Since we plan on cremation, I checked out our state. Depending on where in Pennsylvania you live, a basic cremation without any services other than the oven and a plain small box can run from $1,500 to $2,500. Back in my hometown, where we plan to have the ashes planted in the family plot, opening up the grave is for cremation remains is $450 weekdays and $550 weekends. Tempting to sneak in with a garden trowel and do it yourself, but…

So, with that information, what about a pre-paid funeral? Pre-paid funerals are not without risk and that makes choice of provider critical.

Obvious advantages are a surviving spouse or children won’t have to worry about costs. It’s all done. In the case of someone in extended care who might end up on Medicaid, those funds are off the table for eligibility. Disadvantages are the provider can go out of business and you don’t have much recourse. Also, and I found this hard to believe, if you lose your signed agreement and the provider has not kept a copy, then you may have lost your money. Another drawback might be that over time prices have gone up so a provider will be taking care of current customers paying the higher fees and you may have to wait. And wait. And wait…

Also, some states require a Goods and Services (G&S) Statement. This is basically an itemized list of the goods and services for which one is paying, the sum of which must match the amount of the Irrevocable Funeral Trust. In G&S states, this statement is required to prevent an “improper transfer’, or in other words, a violation of Medicaid’s Look-Back Rule. Failure to provide this statement can result in a Penalty Period of Medicaid ineligibility. You can get that statement from the funeral provider.

In our case we feel pretty comfortable with the two or three primary funeral homes in our area, and I would most definitely keep copies of the agreement with me and each of kids, so I would not be too worried about the risks. The only risk might be if, after we bought it, the home was bought by a chain and you no longer had that local connection. But you can only worry about so much.

THERE IS ANOTHER option that sets money aside, meets the Medicaid requirements and avoids the risk – an irrevocable funeral trust.

If you go this route your costs will go up some because you will want your lawyer and CPA involved. Here’s how it works. The trust is “irrevocable” meaning that once you put the money in it, it no longer belongs to you. It must be used for the designated purpose. In this case you would want to price the services you want, either the most simple and cheapest cremation or full burial to the most elaborate. Then, factor in a few years worth of inflation.

Also, you may want to ask if you need the Goods and Services Statement mentioned above for a trust.

You can designate who manages the money upon your death. You can have it go directly to a funeral home as the beneficiary, but if that funeral home goes belly up, not good. You can have a designated person, one of your heirs for example, to manage the process.

Can a couple set up such a trust? Yes, but talk to your lawyer, CPA, financial advisor or whomever you are working with. Again, I am not offering any kind of financial or legal advice on complex issues, just pointing out things to think about.

There is one more option, and that is a revocable trust. That means you do not give up ownership of the money and can take it out any time and use it for other than funeral expenses. But since you can do that Medicaid will consider it an asset and you will have to fork it over or use for care before you can go on Medicaid. If you are absolutely certain you will never be facing Medicaid, that might make sense. But it’s also a temptation and if your main goal is to keep your heirs from having to fork over funeral costs, you might want to think twice.

What will we do? Not sure. I think I am leaning toward the irrevocable trust, simply because it protects against some of the downsides of a pre-paid funeral paid directly to one funeral home. But, I’m going to do something, and sooner rather than later, not so much because I really think we will go on Medicaid but because I want to make things easy on the kids.

Rich Heiland, has been a reporter, editor, publisher/general manager at daily papers in Texas, Pennsylvania, Illinois, Ohio and New Hampshire. He was part of a Pulitzer Prize-winning team at the Xenia Daily (OH) Daily Gazette, a National Newspaper Association Columnist of the Year. Since 1995 he has operated an international consulting, public speaking and training business specializing in customer service, general management, leadership and staff development with major corporations, organizations, and government. Semi-retired, he and his wife, Connie, live in West Chester, PA. He can be reached at [email protected].