The wills you drew up when you were healthy may not serve you when long-term care is involved. There are complexities around long-term care and estates that make “do it yourself” planning very risky. You will need a team…..

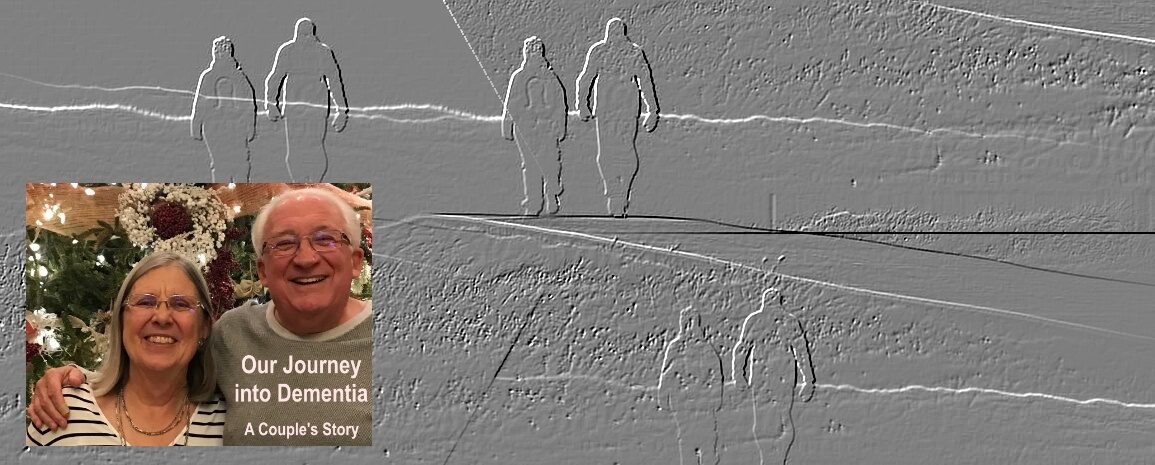

This is part of an ongoing series about our family’s experience with dementia. There is no order to it, just observations, reflections and, I hope, some guidance for others on this journey or who may someday begin it. It is not intended as any sort of financial, medical or psychiatric advice. Just one family’s experience…

A FEW WEEKS ago, something dawned on me.

A care facility could end up “inheriting” our estate.

It was a big gorilla in the corner of the room that in all the hustle and bustle of dealing with Connie’s dementia I had overlooked.

You may recall I’ve posted about our decision to move Connie into a memory care unit as well as about some of the ways people facing long-term care decisions can end up broke. I overlooked in all that estate planning. Or, in our case, estate replanning.

I am going to assume that all of you out there have wills. If you don’t you are, well, stupid. Even a single 20-something who owns very little should have a will. For that 20-something doing a simple on-line will is probably sufficient. But the moment that 20-something buys a home, starts investing, a serious will is in order.

I have some simple advice on creating a will. Get to a lawyer. Period. While I just said a simple on-line will might work for a single 20-something with no assets, for the rest of us we need a will created by a lawyer.

Connie is a lawyer, but she never did our wills. When we lived in Huntsville, TX she worked with Sam Moak. We had Sam do our wills. We wanted the outside objectivity and advice. When we moved to Pennsylvania we had our wills and medical and financial powers of attorney redone by an attorney in West Chester. There was nothing “wrong” with the wills Sam did back in Texas, and a lot of that was retained. However, laws around estates vary from state to state so if you relocate it’s wise to have your will redone or at least updated under the laws of that state.

That is what I am in the process of doing. I also am working with our financial advisors to make changes in all our IRAs and investments that involve beneficiaries.

Why? Over the years Connie has been adamant she wanted to leave something to our two children. We would never be able to make them wealthy, but she wanted to leave them a nest egg to put toward their retirement.

Once she moved into a care unit, that was in jeopardy. Here’s the deal.

Our care facility has a policy that it will only draw down half a couple’s assets. When that half-way point is reached, it will use its own “care fund” and possibly Medicaid. (Can one spouse be on Medicaid and the other spouse keep their assets. Yes, but it’s complicated and that’s a topic for another day.)

BUT, WHAT HAPPENS if I die first? Under our current will and investment beneficiary designations Connie would inherit my half of our assets. And, that 50 percent drawdown mentioned above is not in play. The care facility could draw down our estate in its entirety, leaving nothing for the kids.

Is that likely? Given we have long-term care insurance that will cover 75 percent of our cots for roughly six years, it isn’t likely. But, it could happen.

That is why I am changing my will to basically “disinherit” my wife. I am changing my beneficiary designations from her to our kids on a shared basis. FYI: Connie’s will as drawn up is fine and needs no changes.

I started with some value statements. We have an obligation to always be able to provide the care facility with 50 percent of our assets. Everything I do has to be done in a way that honors that. Another value is that I am not going to play any “tax games.” This is not about tax avoidance, though certainly instruments that are totally legal and work to minimize tax exposure are on the table.

After looking at how things are structured now. I can change the beneficiaries and my will and still leave Connie with sufficient assets to meet obligations to the care facility. And I (we) can achieve her goal of leaving some to the kids.

Basically, if I die first the kids will get that nest egg Connie wanted them to have. Any cash we have in checking, savings or CDs will be dealt with by the will in a way that ensures our son, who lives locally and will be managing things, will have sufficient cash flow to meet Connie’s monthly needs.

Will I be creating any trusts? I don’t know. There are several trust approaches that could play into protecting assets if we end up needing Medicaid for Connie. I may, after talking to the lawyer, go that route. Or, not.

So, why I am sharing all this? Because it applies to you, dear readers. If you find yourself facing the prospect of putting a loved one in care, be it memory, nursing or assisted living, you are going to need to meet with your financial advisors and lawyer to review your estate plans to see if they meet your new reality.

Redoing everything is not going to be cheap in terms of initial outlay, but whatever I spend to re-visit our estate planning is chump change compared to the possible costs of not doing it.

So, I’d ask you:

- Do you have a lawyer? The answer should be “yes” and if it’s not, get one. Consider an elder law attorney. If they don’t do wills, you may need two attorneys.

- Do you have a financial advisor? If not, get one. I personally recommend one who is not going to be selling you investments but offering you independent advice. However, both of our financial advisors are associated with various products, but we trust them implicitly and they never have tried to “hard sell” us anything.

- Do you have an accountant? We never did because I was in business, Connie was an attorney and we could do our own taxes just fine. Now, there are things that are out of my wheelhouse so we have a good, local CPA on the team.

- Do your offspring know the status of your estate? Our kids know to the penny what we have. If you don’t trust your kids, that’s another issue.

ONE LAST THOUGHT….. Under my will, and as beneficiaries to my investments and retirement accounts, our son will receive 55 percent of assets and our daughter 45 percent. Why? Because our son lives 10 minutes away and our daughter lives in Europe. Our son is going to carry a heavy of load when it comes to handling things on the ground. I am basically paying him a management fee.

When my parents were aging I had them and my sister sit down their attorney and change their wills to give my sister 55 percent and me 45 percent because I lived away and no matter how many times I would pass through, I’d never shoulder the physical load my sister would, and did. None of them wanted to do it but I insisted. Their attorney said it was the first time he’d ever had a child ask for that. I am surprised not more do. After Mom died my sister said, only half joking, that “I wish I’d asked for more.”

So, there it all is. I didn’t think of a lot of this while we were entering into how we would deal with Connie’s dementia. There an old East Texas saying that “when you are up to your ass in alligators it’s hard to remember you waded in to drain the swamp.” Now that I’ve gotten the alligators out of the way, it’s time to deal with the swamp. You will face that, too. Start planning now!

Rich Heiland, has been a reporter, editor, publisher/general manager at daily papers in Texas, Pennsylvania, Illinois, Ohio and New Hampshire. He was part of a Pulitzer Prize-winning team at the Xenia Daily (OH) Daily Gazette, a National Newspaper Association Columnist of the Year. Since 1995 he has operated an international consulting, public speaking and training business specializing in customer service, general management, leadership and staff development with major corporations, organizations, and government. Semi-retired, he and his wife live in West Chester, PA. He can be reached at [email protected].

Excellent counsel, my friend. Thanks for sharing.

I am 88.

I’ve done most of what you mention.

I have longterm care that has escalated to a chunk of $800 per month. It will only ever cover me for 3 years, no more, IF I am essentially helpless; can’t walk, dress myself, can’t feed myself, can’t wash myself, stuff like that. Today I would say I will never use it. Should I continue with this policy given its cost?

I have considered giving money to my three children while I am alive. Is that ok?

I’m lunching with my Ameriprise financial advisors and stock broker tomorrow.

I left my lawyer. We got to be in opposition. To me my lawyer is my advocate.

I guess I’m just venting because you wrote about the subject. You are doing a good job. Any questions tucked in here, you’ll probably say “up to you.”

I’ve done quite a bit over the

years and situations DO change. All the best,

Henry Hank Chapin

Hank.

If you have something other than dementia – cancer, some other disease that could land you in nursing care – then three years is probably adequate and it would be worth having. Yes, you can give money to the kids but you need to talk to your lawyer, CPA. Tax implications for the kids if you gift it are different than an estate. May want to consider a trusts. Your lawyer should be your advocate, yes.